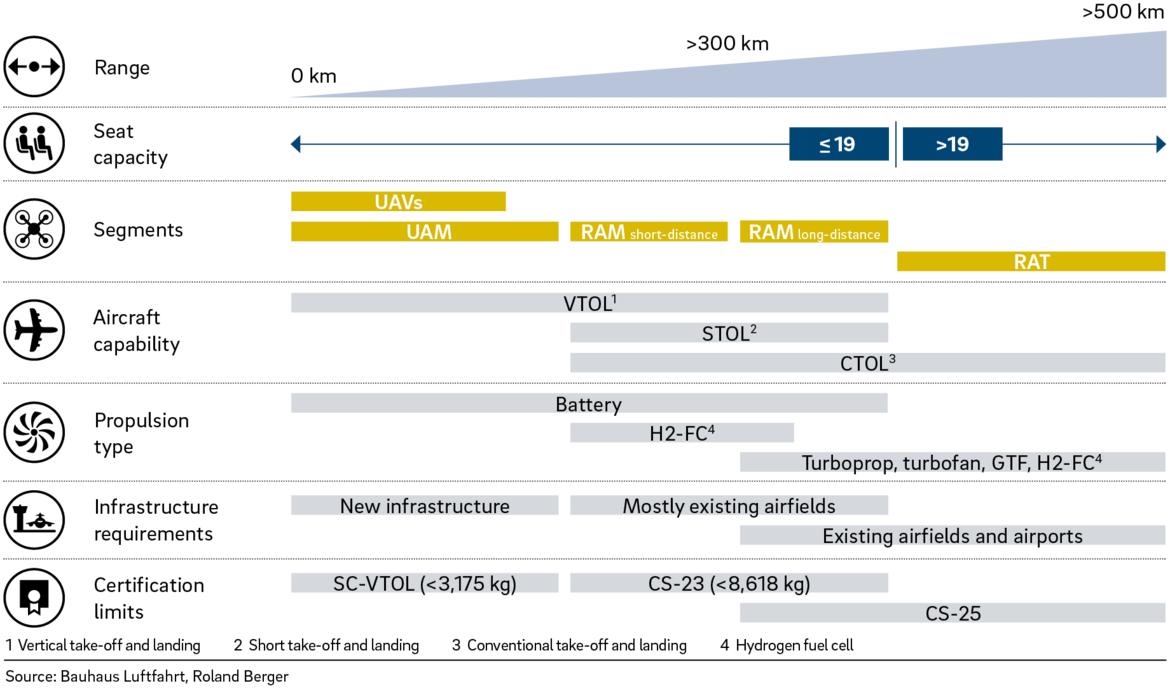

There is now an Advanced Air Mobility (AAM) sector that covers several types of transport for both passengers and cargo, from small eVTOLs, to Regional Air Mobility (RAM) for 19 passengers up to a regional air transport market.

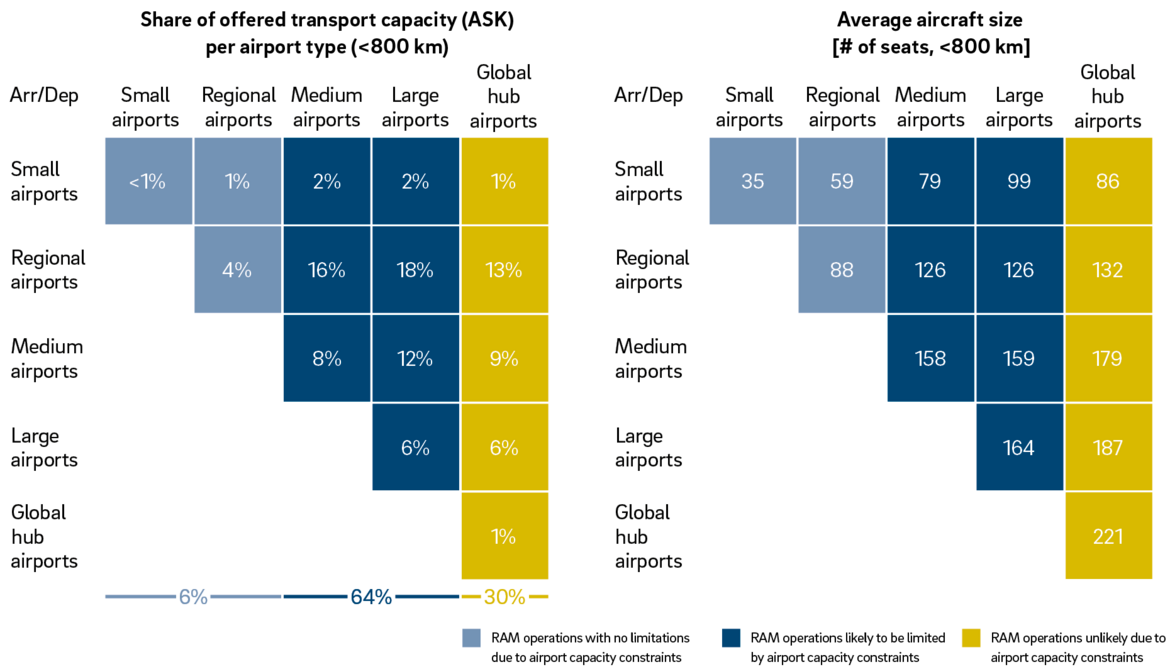

The 19-seater market has steadily decreased since the mid-1990s, mainly due to large, low-cost airlines outperforming regional operators. Over the last three decades, these airlines have increasingly added new, more efficient narrow-body aircraft to their fleets, flying them from regional to medium airports. In the case of competitive total operating costs for RAM vehicles compared to conventional aviation, some existing demand for large commercial short-haul flights could be shifted to RAM. However, the contribution to reducing aviation’s climate impact is rather limited. Only 2 % of aviation’s global transport capacity, as a proxy of direct emissions, is offered on routes shorter than 400 km, increasing to 10 % on routes up to 800 km. A move towards smaller, 19-seater aircraft would result in significantly more air traffic to achieve the same transport capacity. Currently, there is no incentivisation for highly constrained airports to consider smaller aircraft, hence small and regional airports would be best positioned to serve extra flights due to their underutilisation.

Key essential unlockers and underlying market drivers of a revival of Regional Air Mobility were analysed by Bauhaus Luftfahrt together with Roland Berger, and more information can be found in the White Paper “Regional Air Mobility – How to unlock a new generation of mobility”.